Current status and future prospects of natural gas markets in Asia

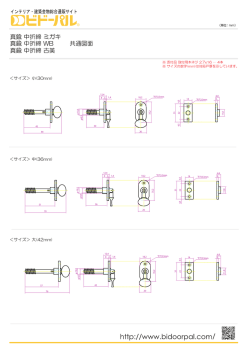

IEEJ : December 2014. All rights reserved Current status and future prospects of natural gas markets in Asia Japan-China Joint Symposium on Asian Oil & Gas The 8th IEEJ/CNPC Research Meeting Meeting-The November 21 21, 2014 The Institute of Energy Economics, Japan Tetsuo Morikawa All Rights Reserved IEEJ : December 2014. All rights reserved Natural gas supply and demand North America Asia Oceania Former Soviet Union Af rica Latin America Middle East Europe North America Asia Oceania Former Soviet Union Af rica 201 12 201 10 200 08 0 200 06 0 200 04 500 200 02 500 200 00 1,000 199 98 1,000 199 96 1,500 199 94 1,500 201 12 2,000 201 10 2,000 200 08 2 500 2,500 200 06 2 500 2,500 200 04 3,000 200 02 3,000 200 00 3,500 199 98 3,500 199 96 4,000 199 94 4,000 199 92 Bcm 199 90 Bcm 199 92 Demand 199 90 Supply Latin America Middle East Europe Source: Cedigaz Rapid supply and demand growth in Asia Oceania and Middle East Shale gas revolution pushing up the supply in North America Sluggish demand continuing in Europe All Rights Reserved 1 IEEJ : December 2014. All rights reserved LNG trades Exports Imports Bcm B Bcm 350 350 300 250 200 150 Angola Yemen Russia Equatorial Guinea 300 Singapore Malyasia Israel Thailand Netherlands UAE(Dubai) Kuwait Chile Canada Brazil Argentina Mexico Dominica Puerto Rico USA Turkey Norway Peru T i id d and Trinidad dT Tobago b USA Egypt Nigeria Libya Algeria Greece Belgium Italy Portugal Oman Qatar Spain France U.K. India UAE(Abu Dhabi) Australia China Taiwan S・Korea Japan M l Malaysia i B Brunei i 250 200 150 Indonesia 100 100 50 50 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 0 1990 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 0 Source: Cedigaz Strong demand in Asia, but demand decrease in Atlantic led to little global demand growth in 2013 PNG LNG and QC LNG as new LNG projects in 2014 All Rights Reserved 2 IEEJ : December 2014. All rights reserved Monthly LNG imports in Northeast Asia and Europe Northeast Asia Europe Million Tonnes 18 Million Tonnes 9 16 8 14 7 12 6 Netherlands UK Turkey Spain China 10 Portugal Italy 5 Greece Taiwan 8 Korea 6 Japan 4 France 4 Belgium 3 2 1 2 0 0 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 2010 2011 2012 2013 2014 8 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 2010 2011 2012 2013 8 2014 Source: Custom statistics, IEA Imports in Jan-Aug 2014: 106.56MT in Northeast Asia (+2.26MT y/y), 23 55MT in Europe ((-2.70MT 23.55MT 2 70MT y/y) European imports still slow due to weak competitiveness of natural gas All Rights Reserved 3 IEEJ : December 2014. All rights reserved LNG export projects in North America Cordova Liard 三菱商事、中部電力 、 東京ガス、大阪ガス、 石油天然ガス・金属鉱物資源機構 (JOGMEC) 国際石油開発帝石 (INPEX)、 日揮 Cutbank Ridge Pacific Northwest LNG (石油資源開発(JAPEX)) 国際石油開発帝石 (INPEX)、 日揮 三菱商事 Aurora LNG (国際石油開発帝石 (INPEX)、日揮 ) LNG Canada (三菱商事) Triton LNG (出光興産) Cove Point LNG 2017年稼働予定 (液化加工:住友商事、 買主:東京ガス、関西電力) 買主:東京ガ 、関西電力) 伊藤忠商事 丸紅 White River mine 三井物産 住友商事 三井物産 住友商事 東京ガス Permian Basin 住友商事 Freeport LNG 2018年稼働予定 (液化加工:中部電力、大 阪ガス、東芝) Cameron LNG 2017年稼働予定 (液化基地:三井物産、JLI(日本郵船・三菱商事) 液化加工:三菱商事、三井物産、GDF Suez 買主:東京電力、東邦ガス、関西電力、東北電力) DOE authorized 9 projects (about 80 MT/y) for export to non-FTA countries Out of those, FERC approved 4 projects (53MT/y) for construction Streamlined authorization process being b i implemented i l t d LNG export projects in North America important in terms of supply l and d pricing i i diversifications 日揮 三井物産 丸紅 大阪ガス 石油資源開発 (JAPEX) 日本企業が関与する LNG輸出プロジェクト シェールオイル・ガス (確認済) シェールオイル・ガス コールベッドメタン コ ルベッドメタン コールベッドメタン All Rights Reserved Source: IEA and company websites 4 IEEJ : December 2014. All rights reserved Europe and Russia Conflicts Ukraine Crisis Asia Shift Source: Added on JOGMEC All Rights Reserved Conflict already evident in terms of the h Thi Third dE Energy Package and pricing of natural gas for Europe (de-oil indexation) Diplomatic relations aggravated by Ukraine Crisis Encouraging E i R Russia i to shift to Asia EU controlling gg gas demand, diversifying supply sources 5 IEEJ : December 2014. All rights reserved Natural gas demand/supply in China Domestic production and imports Gas infrastructures Bcm 30bcm 18 38bcm 16 Domestic production Pipeline gas imports LNG imports 14 12 10 8 6 4 2 0 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 2010 Source: JOGMEC 2011 2012 2013 8 2014 Source: China OGP Russian pipeline gas will contribute to control China’s China s LNG imports All Rights Reserved 6 IEEJ : December 2014. All rights reserved LNG spot and short-term deals Spot imports/exports (2013) Spot and short-term deals Million Tonnes 70 Share of Spot and short-terms deals 27% Middle East 60 Exported cargoes Asia , Oceania, 9 Unknown Unknown, Other 21 Other Middle Africa, 31 East, 4 30% Latin America25% North America Europe Other Asia 20% China h India 15% Taiwan 50 40 Americas (incl (incl. Reload), 11 Other Europe (Reload), 69 30 Korea 10% 20 Nigeria, 57 Norway, 12 Japan 10 Trinidad Tobago, 113 Qatar, 34 5% Imported cargoes Source: GIIGNL 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0% 1996 0 0 Other Asia, 16 Unknown, U k 65 Middle East, 3 Argentina, 102 Other Americas, 10 Americas 10 64.98MT traded by spot and shor-term contracts in 2013 (+4.58MT y/y). Japan imported 21 21.69MT, 69MT sharing 33% of the total total. Nuclear restart will push down spot imports significantly. All Rights Reserved Europe, 8 Taiwan, 10 Brazil, 57 Thailand, 11 Mexico, 15 Korea, 19 Japan, 45 Source: ICIS Heren 7 IEEJ : December 2014. All rights reserved Natural gas demand outlook in Asia Mtoe 1500 AAGR 1980-2011 2011 2040 2011-2040 Ch in a 7.3% 6 3% 6.3% In dia 12.6% 5 5% 5.5% Japan 5.1% 0 2% 0.2% Kore a - 0 8% 0.8% Taipe i Sin gapo r e 7.5% - 2 7% 2.7% 1 7% 1.7% Indonesia Malaysia Phi l i ppi nes Th ailan d Vie tn am Other A s i a 6.5% 3.4% - 4.6% 8.9% 2.7% - 4.1% - 5.4% 6.2% 3.6% 1000 7% 500 China India Japan Korea Taipei Indonesia Malaysia Philippines Thailand Vietnam Singapore Hong Kong Other Asia Tech. Adv. Japan 16% India 21% China 42% 11% 23% 0 1971 1980 1990 2000 2011 2020 2030 2040 Source: IEEJ China and India will lead the Asian demand growth. All Rights Reserved 8 IEEJ : December 2014. All rights reserved LNG supply/demand outlook World Asia and Middle East Million Tonnes 1 000 1,000 Million Tonnes 600 Divertable capacity from Atlantic Under planning 900 New projects with HOA/SPA signed Under plannning 500 800 New projects with HOA/SPA signed Existing gp projects j 700 Hight demand 600 Existing projects 400 Low demand High demand 500 300 Low demand Low demand 400 200 300 200 100 100 0 2012 2015 2020 2025 0 2030 2012 2015 2020 2025 2030 Source: IEEJ New projects will ease LNG market towards 2020. Timely investment is the key to realize ample supply potential post 2020. All Rights Reserved 9 IEEJ : December 2014. All rights reserved International natural gas prices $/MMBtu 25 20 15 10 5 0 Jan-00 Japan Jan-02 Jan-04 Jan-06 Jan-08 LNG spot assessment price for Northeast Asia Jan-10 UK Spain Jan-12 Germany Jan-14 USA Source: Energy Intelligence, EIA Asia premium of LNG still significant, yet spot prices dropped significantly in this summer All Rights Reserved 10 IEEJ : December 2014. All rights reserved LNG pricing options for Asia Hub pricing Henry Hub, NBP Advantages Disadvantages Hubs in Asia Spot LNG pricing • Already available • Lower prices (for now) • Possible to reflect regional market balance • Already available • Higher volatility • Asia market balance not reflected • Not yet available • Higher volatility • Higher volatility • Limited liquidity (so far) Adjustment within pricing g oil-linked p Link with other fuels (Electricity, Coal) • Possibly the quickest solution • Rational for power utilities •Gas market balance not reflected • Lack of power market liquidity Rationality of oil-linked pricing being questioned Sustainable and rational p pricing g needs to emerge g for mutual benefit between sellers and buyers All Rights Reserved 11 IEEJ : December 2014. All rights reserved LNG Producer-Consumer Conference 2014 Held on November 6th About 1,000 attendee from more than 50 countries Program * Yoichi Miyazawa, Minister of Economy, Trade and Industry * Mohammed Bin Saleh Al-Sada, Minister of Energy and Industry, Q t Qatar Keynote speeches * Ian Macfarlane, Minister for Industry, Australia * Greg Rickford, Minister of Natural Resources, Canada * Maria van der Hoeven, Executive Director, International Energy Agency All Rights Reserved Session 1 LNG supply outlook & Actions by producers Session 2 LNG demand outlook & Actions by consumers Session 3 New movement towards developing flexible LNG market and change in LNG trade Session 4 LNG technology developments 12 IEEJ : December 2014. All rights reserved LNG Producer-Consumer Conference 2014 Participants shared view on weakening Asian LNG market Japan’s p import p p price can be 20-30% lower ((Minister Miyazawa) y ) New capacity in Australia will weaken LNG market (Minister Macfarlane) Appeal from the US west coast LNG projects LNG buyers accessible to cost-base LNG Relatively shorter transportation distance No Panama canal risk Existing g infrastructure available Still searching for alternative pricing to replace oil indexation Price level vs Pricing Hybrid pricing as a transitional measure How will we establish Asian benchmark prices? All Rights Reserved 13 IEEJ : December 2014. All rights reserved Multilateral joint study group on LNG Proposed by IEEJ at the LNG Producer-Consumer Conference 2013 Participants Members: Research institutes from LNG importing/exporting countries, International organizations Observers: Government agencies Workshops in February and September in 2014 Policy recommendations at LNG Producer-Consumer Conference 2014(http://eneken.ieej.or.jp/press/press141106a.pdf) Cooperation between sellers and buyers, governments and companies i Pricing diversifications Flexible and transparent market developments All Rights Reserved 14 IEEJ : December 2014. All rights reserved Conclusions Natural gas supply and demand Demand strong in Asia Asia, still weak in Europe LNG market being weakened Decreased spot LNG prices Issues in major countries Expectation raising for North American LNG Russia’s shift to Asia Supply diversifications by China LNG Producer-Consumer P d C C Conference2014 f 2014 Shared view on weaker market US west coast LNG How can Asian benchmark prices be established? Flexible and transparent p LNG market needed All Rights Reserved 15 Contact : [email protected]

© Copyright 2026