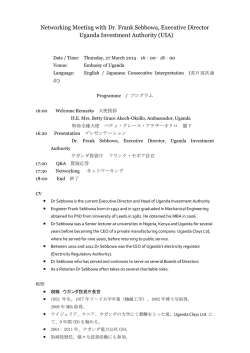

Page 1 Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 gg HーT