FY Ended March 2014 Full Year Results Presentation

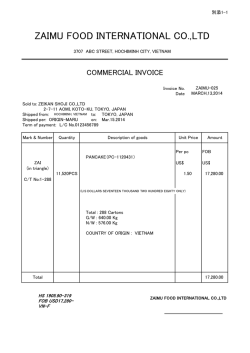

FY Ended March 2014 Full Year Results Presentation May 29th, 2014 Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. Contents FY Ended March 2014 Full Year Results ------------ p.2 FY Ending March 2015 Full Year Forecasts -------- p.11 p.16 Business Environment -------------------------------------Future Activities ----------------------------------------- p.26 Dividends -------------------------------------------------- p.38 Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 1 FY Ended March 2014 Full Year Results Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 2 FY Ended March 2014 Full Year Results Consolidated Statements of Income (Summary) Earned acclaim from halls for the brand's comprehensive strength ・・・Information System Segment marked record sales FY Ended March 2014 Net Sales 58,861 56,954 △3.2% +11.7% Gross profit-net 18,776 18,691 △0.5% +9.9% Selling, general and administrative expenses 11,753 13,353 +13.6% +2.7% Operating Income 7,023 5,338 △24.0% +33.5% Ordinary income 7,244 5,474 △24.4% +36.9% Net income 4,161 3,278 △21.2% +63.9% Research and development expenditure 2,720 3,656 +34.4% +4.5% (Millions ¥) YoY Change Vs. Forecasts Change FY Ended March 2013 (Note) The planned ratio is the value of earnings projection for the term ending in March 2014 announced on November 11, 2013, as well as the planned ratio described in the materials for the briefing of the second quarter closing of the term ending in March 2014 held on November 28, 2013 targeting institutional investors and analysts. ■ Factors of sales decrease In the term ending in March 2014, the Information System Segment marked record sales since its inauguration attributable to the highly acclaimed CR unit (prepaid type inter-machine ball dispenser) and data display tools, but the sales of the Control System Segment declined partly because the number of sales models engaged in by the Company was small. ■Stability factors of gross margin on sales The gross margin on sales is attributable to the sales growth in the Information System Segment that has good profit margins. ■Factors of increased sales administrative expenses The Company has started to aggressively invest in the development of next-generation product lines in the Information System Segment. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 3 Operating Income YoY Change -¥1,685 Million (Millions of yen) -85 Gross profit-net -936 Research and development expenditure -664 The others FY2013 Results 7,023 FY2014 Results 5,338 Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 4 Shifts in net sales and operating income (Millions of yen) Net sales Operating income 7,023 58,861 56,954 51,857 5,338 47,096 4,626 34,483 3,525 226 FY2010 2011/3期 FY2011 2012/3期 FY2012 2013/3期 FY2013 2014/3期 FY2014 2010/3期 FY2010 2011/3期 FY2011 2012/3期 FY2012 2013/3期 FY2013 2014/3期 FY2014 2010/3期 売上高 営業利益 Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 5 FY Ended March 2014 Full Year Results Consolidated Balance Sheets (Summary) YoY Change 2013/3 2014/3 Current assets 39,789 37,045 ‐2,744 Noncurrent assets 16,916 16,884 ‐32 Total assets 56,706 53,929 ‐2,776 Current liabilities 24,544 20,159 ‐4,385 Noncurrent liabilities 1,722 1,509 ‐213 (Millions ¥) ■ Total assets (YoY Change) -¥2,776 million Current assets -¥2,744 million There was an increase in non-revenue money in the term ending in March 2015, but this was due to a large decrease in cash and deposits as well as raw materials. Noncurrent assets -¥32 million The disposal of idle assets, etc., are decreasing factors. Total liabilities 26,267 21,669 ‐4,598 Net assets 30,439 32,260 +1,821 Total liabilities and net assets 56,706 53,929 ‐2,776 Debt 1,269 800 ‐469 ‐0.02times 0.04times 0.02times 53.7% 59.8% +6.1% Receivables turnover period 61.6days 73.5days +11.9days Inventory turnover period 45.7days 55.8days +10.0days Payable turnover period 88.3days 105.8days +17.4days Debt Equity Ratio Capital adequacy ratio ■ Total liabilities (YoY Change) -¥4,598 million Although there was an increase in accounts payable, this was due to a large decrease in trade payables and income tax payables, etc. ■ Net assets (YoY Change) +¥1,821 million This was due to the increase in retained earnings. In addition, the owned capital ratio was 59.8%, a 6.1% increase compared to the previous consolidated fiscal year. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 6 Research and development expenses・Increase of tangible fixed assets and intangible assets・ Operating CF・Shareholders' equity 9,600 59.8% 35,000 60.0% 2,720 3,000 3,123 2,275 1,684 1,855 0 340 -2,792 研究開発費 FY2014 2014/3期 FY2013 2013/3期 FY2012 2012/3期 -3,000 Research and development expenses 有形固定資産及び無形固定資産の増加額 Increase of tangible fixed assets and intangible assets 営業キャッシュフロー Operating CF 30,000 50.0% 27,026 25,953 25,000 40.0% 20,000 30.0% Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 2014/3期 FY2014 3,656 2013/3期 FY2013 3,589 32,260 30,439 2012/3期 FY2012 2,505 53.7% 52.9% 2011/3期 FY2011 6,000 自己資本(百万円) equity (Millions ¥) Shareholders‘ 5,682 FY2011 2011/3期 研究開発費、固定資産増加額、営業CF (百万円) ¥) (Millions 55.1% 自己資本比率(%) equity ratio(%) Shareholders‘ 9,000 Shareholders‘ equity 自己資本 Shareholders‘ 自己資本比率 equity ratio 7 FY Ended March 2014 Full Year Results Consolidated Statements of Cash Flows(Summary) (Millions ¥) FY Ended March 2013 FY Ended March 2014 YoY Change ■ Operating CF (compared to the previous period) -¥9,260 million The proceeds of cash from sales activities was ¥340 million, and a major part of it was due to a large decrease in the amount of trade payables attributable to the last day of the previous consolidated fiscal year falling on a bank holiday as well as the payment amount for corporate income taxes and the like being large. Operating CF 9,600 340 △9,260 Investment CF 2,153 △1,655 3,808 Financing CF △7,003 △1,809 +5,194 Cash and cash equivalents 18,406 15,281 △3,124 Time deposits that have more than three months until maturity ■ Investment CF (compared to the previous period) -¥3,808 million The expenditure of funds from investing activities was ¥1,655 million, and a major part of it was due to large expenditures on non-current assets attributable to production equipment and refurbishments costs of our branch offices as well as the costs to upgrade software. ■ Financing CF (compared to the previous period) +¥5,194 million 100 100 0 The expenditure of funds from financing activities was ¥1,809 million, and a major part of it was due to the repayment of debts and the payment of dividends. ■ Cash and cash equivalents (compared to the previous period) -¥3,124 million The cash and cash equivalents in this consolidated fiscal year amounted to ¥15,281 million, a decrease of ¥3,124 million. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 8 Business results by segment YoY Change 前期比 (Millions ¥) Information System Segment Net sales Net sales -¥1,907 million (-3.2%), Operation income -¥1,685 million (-24.0%) FY Ended FY Ended March 2013 March 2014 31,685 36,065 YoY Change +13.8% Vs. Forecasts +16.3% ■ Information System Segment Marked record sales since the inauguration: Sales of CR unit and data display tools contributed. (1) The Company strove to further improve customer satisfaction by making efforts such as enhancement of "C II Standard," a hall supporting service using the MIRAIGATE network. Segment income 6,069 6,093 +0.4% +10.8% Net sales 27,184 20,889 -23.2% +4.4% Segment income 2,930 1,127 -1,976 -1,883 -4.7% -0.9% Net sales 58,861 56,954 -3.2% +11.7% Operating income 7,023 5,338 -24.0% +33.5% Sales went down partly because the number of sales models the Company was involved in was small. (Note) The planned ratio is the value of earnings projection for the term ending in March 2014 announced on November 11, 2013, as well as the planned ratio described in the materials for the briefing of the second quarter closing of the term ending in March 2014 held on November 28, 2013 targeting institutional investors and analysts. The sales of peripheral components such as liquid crystal panels, motors, switches and power supplies performed steadily through efforts to strengthen proposals for planning capabilities and augment the development line by fusing with Group companies. Control System Segment Corporate expenses Corporate -61.5% +181.8% (2) "VEGASIA", a CR unit that highlighting enhanced security and effective operational capacity, "BiGMO PREMIUM", an improved version of BiGMO with a larger monitor and higher functionality, and "IL-X", a call-out lamp, were highly valued in the market, contributing to favorable performance in sales. ■ Control System Segment Business segment sales and income figures include intersegment transactions. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 9 Business results by segment Business segment sales 27,184 26,289 Segment operating income 2,930 20,889 1,127 21,367 2,752 583 11,054 6,069 6,093 FY2013 FY2014 4,793 31,685 25,595 23,492 36,065 3,834 3,047 25,741 -1,088 FY2010 FY2011 FY2012 FY2013 FY2014 Information System Segment FY2010 FY2011 FY2012 Control System Segment (※)Business segment sales and income figures include intersegment transactions. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 10 FY Ending March 2015 Full Year Forecasts Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 11 Future outlook ○Net Sales ¥1,954 million decrease ■ Information System Segment (¥3,065 million decrease) ¥36,065 million→¥33,000 million The Information System Segment will further promote sales of "VEGASIA" (a CR unit with enhanced functions, etc. in conjunction with the hall computing system "C II") and data display tools per machine centering on "BiGMO PREMIUM" (a new model released in November 2013 with a high evaluation in the market). ■ Control System Segment (¥1,111 million increase) ¥20,889 million→¥22,000 million Aiming to improve operating performance, the segment will activate collaboration with partners with technological strength for the expansion of business domains and will engage in creating machines with a market outlook of three years ahead. ○Sales administrative expense (¥1,647 million increase) ¥13,353 million → ¥15,000 million The main factors of increase are development expenses (Information - ¥900 million increase, Control - ¥100 million increase), outsourcing expenses, sales promotion expenses, sales fees, etc. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 12 Forecast earnings for the year ending March 31, 2015 Year ended March 31, 2014 (Millions ¥) First half Second half Total Year ended March 31, 2015 (Forecast) First half Second half YoY Change Total Net Sales 25,882 31,072 56,954 27,000 28,000 55,000 ‐3.4% Gross profit-net 8,191 10,500 18,691 8,500 9,500 18,000 ‐3.7% Selling, general and administrative expenses 5,704 7,649 13,353 7,000 8,000 15,000 +12.3% Operating income 2,487 2,851 5,338 1,500 1,500 3,000 ‐43.8% Ordinary income 2,559 2,915 5,474 1,500 1,500 3,000 ‐45.2% Net income 1,543 1,735 3,278 1,000 1,000 2,000 ‐39.0% Net income per share 104.38 ― 221.80 67.64 ― 135.29 ― Research and development expenses 1,125 2,531 3,656 1,700 3,000 4,700 +28.6% Depreciation expense 688 764 1,452 700 900 1,600 +10.2% Capital investment 192 797 989 300 300 600 ‐39.3% Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 13 セグメント別売上見込 Year ended March 31, 2015 (Forecast) Year ended March 31, 2014 (Millions ¥) Information System Segment Control System Segment Control System Segment Total First half Second half Total 15,562 20,503 36,065 15,000 18,000 33,000 Segment income 2,950 3,143 6,093 2,300 2,000 4,300 Net Sales 10,320 10,569 20,889 12,000 10,000 22,000 508 619 1,127 100 400 500 ‐970 ‐913 ‐1,883 ‐900 ‐900 ‐1,800 Net Sales 25,882 31,072 56,954 27,000 28,000 55,000 Segment income 2,487 2,851 5,338 1,500 1,500 3,000 Segment income Sales ratio (First half:Second half) Information System Segment Second half Net Sales Corporate expenses Corporate First half 45.4% 54.6% 100% 49.1% 50.9% 100% Hall computing system 「C」(unit) 90 113 203 90 110 200 Disclosure of information system 3,741 5,821 9,562 3,800 4,700 8,500 Prize management system 1,901 1,937 3,838 1,600 1,900 3,500 Network services 1,363 1,499 2,862 1,500 1,650 3,150 6 12 18 7 7 14 2,958 7,125 10,083 4,500 5,800 10,300 7,243 4,000 1,500 5,500 Video processing unit (Number of models) Video processing unit 4,659 2,584 (※)Business segment sales and income figures include intersegment transactions. Sales of parts Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 14 <参考資料>セグメント別売上推移(3期分) Year ended March 31, 2011 (Millions ¥) Information System Segment Control System Segment Second half Total First half Second half Total First half Second half Total Net Sales 11,379 12,112 23,492 11,553 14,187 25,741 16,724 14,960 31,685 Segment income 1,954 1,093 3,047 1,765 3,028 4,793 4,030 2,039 6,069 Net Sales 5,133 5,921 11,054 16,552 4,814 21,367 10,947 16,236 27,184 Segment income ‐447 ‐641 ‐1,088 1,325 ‐741 583 549 2,381 2,930 ‐894 ‐838 ‐1,732 ‐972 ‐879 ‐1,852 ‐976 ‐1,000 ‐1,976 16,510 17,972 34,483 28,100 18,995 47,096 27,665 31,195 58,861 612 ‐386 226 2,118 1,407 3,525 3,603 3,420 7,023 47.9% 127 2,467 2,737 642 3 1,556 2,355 52.1% 104 2,721 3,252 715 7 2,856 1,786 100% 231 5,188 5,989 1,357 10 4,412 4,141 59.7% 120 2,493 2,525 732 6 11,036 3,485 40.3% 123 4,051 2,721 954 3 1,492 2,481 100% 243 6,544 5,246 1,686 9 12,528 5,966 47.0% 118 4,310 2,252 1,113 9 5,933 4,365 53.0% 87 3,847 1,795 1,294 11 9,906 5,053 100% 205 8,157 4,047 2,407 20 15,839 9,418 Net Sales Segment income Sales ratio (First half:Second half) Hall computing system 「C」(unit) Information Disclosure of information system System Prize management system Segment Network services Control System Segment Year ended March 31, 2013 First half Corporate expenses Corporate Year ended March 31, 2012 Video processing unit (Number of models) Video processing unit Sales of parts (※)Business segment sales and income figures include intersegment transactions. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 15 Business Environment Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 16 Recent industry trends and outlook ○ Recent industry trends (1) According to the DK-SIS data of the Company, there has been a gradual downward trend on a continual basis in the performance of pachinko halls in the last few years, and 2013 recorded the lowest ever operation and profit. The decline in operations of pachinko game machines (especially ¥4 dispensing pachinko) has continued, and the operation of pachislot game machines that performed steadily since 2009 and onwards peaked, making it impossible to compensate for the performance of the entire hall, thus causing a severe situation to persist. (2) While aggressive investments such as for new pachinko halls and remodeling of big halls were made by large-scale chain stores, the number of halls that have closed or suspended the operations has increased, and it is believed that the performance disparity between hall management companies is getting bigger. (3) The number of halls nationwide during the 2013 fiscal year was 11,893 (-256 stores). The number of game machines installed nationwide increased for the fourth consecutive year at 4,611,714 (+19,678 machines) due to the increase in pachislot game machines (+52,829 machines), although the number of pachinko game machines decreased (-33,162 machines). The number of game machines installed per store increased to 387.8 (+9.8 machines), reflecting the situation in which the enlargement of hall size is progressing even more. (Data) According to the 2013 White Paper on Adult Entertainment Business issued by the Community Safety Bureau of the National Police Agency Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 17 Recent industry trends and outlook ○ Industry trends in the present (1) Although the Japanese economy is on the course of a gradual economic recovery against the backdrop of the effects of the further economic measures and financial policies by the government, the outlook is uncertain due to the consumption tax hike. Also, in terms of the pachinko industry, which is a leisure industry in which the Company is engaged, it is believed that the spread towards economic recovery will still take a while, but it is projected that in the medium term the economy will recover gradually towards the hosting of the "2020 Tokyo Olympics". (2) The pachinko hall market of the current fiscal year is still not headed for expansion, and its scale is assumed to be about the same as the previous fiscal year. Each company is still tending to be cautious of expanding company size, and it is believed that each will make efforts to attract customers at existing halls. It is thought that the effects of advertising and game machine replacement are high just as before, but it is difficult to make an aggressive move in consideration of advertising regulations and cost-effectiveness, so it is assumed that companies will aim for the maintenance and improvement of customer attraction by enhancing facilities that provide a comfortable game environment for fans such as through continuing to implement and replace public information terminals as well as updating air conditioning equipment. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 18 Changes in the size of market total gross profit and shifts in performance by year Although market conditions are projected to be severe in the short term, it is expected to recover towards a ¥4 trillion market size in the medium term Pachinko business scale [Changes in the size of total gross profit and performance by year] (Note) Source of survey materials: Daikoku Denki "DK-SIS" Market trends in the present envisioned by the Company (estimate of the Company) Recovery of ¥4 trillion size of market gross profit Consumption tax hike Hosting of Tokyo Olympics ※The gross profit size data is the value obtained by inference based on the market data from DK-SIS data ※Running time per hour is calculated by 5000 balls for pachinko and 2000 coins for pachislot Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 19 Reference) Shifts in the average amount of a corporate worker's pocket money Since the 1990s, pocket money of a corporate worker in Japan has shifted in a downward trend. Trend of increase of the base amount is expanding. Partly due to the shortage of manpower, it is highly assumed that the salaries at Japanese companies will continue to grow for the time being In the short term, due to the impact of the consumption tax hike, the amount of pocket money may decline, but in the medium term, it is anticipated to increase. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 20 Pachinko business scale Shifts in the number of pachinko halls and installed pachinko and pachislot game machines (halls) 18,000 (thousand machines) 6000 16,988 16,000 店舗数 Number of pachinko halls 16,801 16,504 16,076 15,617 15,165 14,674 4,611,714 14,000 12,000 (+19,678) 5000 Peak of total game machines(2004) 13,58512,937 12,652 12,479 12,323 4,969,156 machines 12,149 11,893 4000 Peak of Pachinko game machines(1996) 3,906,767 machines 10,000 パチンコ台数 Number of pachinko game machines パチスロ台数 Number of pachislot game machines Number of total game machines 遊技機総台数 3,009,314 (-33,162) 8,000 3000 ■Number of pachinko halls 11,893 halls (-256 halls YoY) 2000 6,000 1,602,148 4,000 Peak of Pachislot game machines(2006) 2,003,482 machines ■ Number of game machines (+52,829) 1000 2,000 387.8 machines per hall (+9.8 machines YoY) Total 4.61million machines 0 0 (+19,678 machines YoY) 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 ( Source of data ) The 2013 White Paper on Adult Entertainment Business issued by the Community Safety Bureau of the National Police Agency Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 21 Changes in gross profit structure (Comparison of April 2011 - 2014) 2011/4 2012/4 2013/4 2014/4 ( Source of data ) “DK-SIS White paper” Daikoku Denki gross profit share 57% 50% 49% 47% 13% 14% 14% 2011 57% 12% 29% 2% 2012 50% 13% 35% 2% 2013 49% 14% 34% 3% 2014 47% 14% 35% 4% 2011 ¥4 pachinko 50% Pachinko(low-price dispenser) 20% ¥20 pachislot 27% Pachislot(low-price dispenser) 3% 2012 45% 22% 29% 4% 2013 42% 23% 28% 7% 2014 40% 24% 29% 7% ¥4 pachinko Pachinko(low-price dispenser) ¥20 pachislot Pachislot(low-price dispenser) 12% number of machines share 29% 2% 35% 34% 35% 2% 3% 4% ¥4 pachinko ¥20 pachislot Pachinko(low-price dispenser) Pachislot(low-price dispenser) <Reading and understanding from gross profit share> ○ Decline of ¥4 pachinko ○¥20 pachislot shifting from increase to flat ○Gradual increase of pachislot (low-price dispenser) Advance indicators of pachinko hall creation (configuration of the number of machines) Continuous decline of ¥4 pachinko share Flat performance of low-price dispensing pachinko share Slight increase of ¥20 pachislot share Shift towards increasing trend of low-price dispensing pachislot share Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 22 Hall computing system that accounts for the top share of the market at 35% Hall computing system Daikoku Denki excelled in the production of electric circuits at its inauguration, and developed a device to count pachinko balls by utilizing this knowledge and technology. Later, the Company was the first in the industry to provide new products and services such as through a proprietary system to collect and manage the data of each machine, in addition to the development of "Data Robot", an information terminal that displays game machine data to customers, and "DK-SIS", a service to provide information that supports hall management, as well as the launch of the "MIRAIGATE" brand. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 23 DK-SIS Daikoku Denki Strategic Information System "DK-SIS"—an industry-leading strategic information tool that helps to realize improved hall performance Strengths of DK-SIS ● Accumulation of business know-how with a core of data on approximately 1.29 million game machines and ¥9.7 trillion scale of annual sales ● Provision of various consulting services with DK-SIS data as the backbone ● Strategic proposals and sales activities to game machine manufacturers utilizing DK-SIS data Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 24 Trends in the Number of DK-SIS Members 4,000 3,463 3,591 3,676 Performance for the term ending in March 2014 3,282 3,122 Number of members of members Number 会員ホール数 3,000 3,676 Number of managed machines 1.29 million machines Sales volume Data corresponding to ¥9.7 trillion 2,000 1,000 The only information strategy tool in the pachinko industry that possesses data on 27.9% of the number of pachinko and pachislot game machines nationwide 0 '10/3期 FY2010 '11/3期 FY2011 '12/3期 FY2012 '13/3期 FY2013 '14/3期 FY2014 Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 25 Future Activities Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 26 Strategic direction Make efforts towards stable performance through the sales promotion of data display Ⅰ tools for each machine centering on "VEGASIA", a CR unit, and "BiGMO PREMIUM" as well as the expansion of MIRAIGATE services. Ⅱ Ⅲ Improve profitability over the medium term through new businesses such as the strengthening of the development system of pachislot game machines. Promote aggressive investments towards the development of "next-generation flagship product lines" for pachinko halls. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 27 [Reference] Pachinko business scale 20% 100% 10% 50% 0% 0% -10% -50% -20% -100% 弊社_売上高(四半期、前年同期比) Our net sales (YoY Change) Number of game machines (YoY Change : Dynamic statistical survey of selected service industries) 特定サービス産業動態統計_パチンコホール_設置台数(前年比) Net特定サービス産業動態統計_パチンコホール_売上高(前年比) sales of pachinko halls (YoY Change: Dynamic statistical survey of selected service industries) Our弊社_売上高(四半期_前年比) net sales (YoY) 2013/12 2007年4月 2007/4 2007年8月 2007/8 2007年12月 2007/12 2008年4月 2008/8 2008年8月 2008/12 2008年12月 2009/4 2009年4月 2009/8 2009年8月 2009/12 2009年12月 2010/4 2010年4月 2010/8 2010年8月 2010/12 2010年12月 2011/4 2011年4月 2011/8 2011年8月 2011年12月 2011/12 2012年4月 2012/4 2012年8月 2012/8 2012年12月 2012/12 2013年4月 2013/4 2013年8月 2013/8 2013年12月 特定サービス産業動態統計_パチンコホール of game machines, Net sales of pachinko halls (YoY Number 売上高・設置台数(前年同月比、%) statistical survey of selected service industries) Change: Dynamic Dynamic statistical survey of selected service industries - pachinko hall ( Source of data ) Dynamic statistical survey of selected service industries - pachinko hall (Ministry of Economy, Trade and Industry : 2014/5/14) Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 28 ( Source of data ) Dynamic statistical survey of selected service industries - pachinko hall (Ministry of Economy, Trade and Industry : 2014/5/14) 20% 500% 10% 250% 0% 0% -10% -250% -20% -500% net sales of Control System Segment Our 弊社_制御システム事業_売上高 (YoY Change) (四半期、前年同期比) 特定サービス産業動態統計_パチンコホール_売上高(前年比) statistical survey of selected service industries) Our net sales of Control System Segment (YoY Change) 弊社_制御システム事業_売上高(前年比) 2007/4 2007年4月 2007/9 2007年9月 2008/2 2008年2月 2008年7月 2008/7 2008年12月 2008/12 2009年5月 2009/5 2009年10月 2009/10 2010年3月 2010/3 2010年8月 2010/8 2011年1月 2011/1 2011年6月 2011/6 2011年11月 2011/11 2012年4月 2012/4 2012年9月 2012/9 2013年2月 2013/2 2013年7月 2013/7 2013年12月 2013/12 20% 500% 10% 250% 0% 0% -10% -250% -20% -500% Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 29 (四半期、前年同期比) Our net sales of Information System Segment 弊社_情報システム事業_売上高 (YoY Change) Net sales of pachinko halls (YoY Change: Dynamic 特定サービス産業動態統計_パチンコホール of game machines, Net sales of pachinko halls (YoY Number statistical survey of selected service industries) Change: Dynamic 売上高・設置台数(前年同月比、%) 2007/4 2007年4月 2007/9 2007年9月 2008/2 2008年2月 2008/7 2008年7月 2008/12 2008年12月 2009/5 2009年5月 2009/10 2009年10月 2010/3 2010年3月 2010/8 2010年8月 2011年1月 2011/1 2011年6月 2011/6 2011年11月 2011/11 2012年4月 2012/4 2012年9月 2012/9 2013年2月 2013/2 2013年7月 2013/7 2013年12月 2013/12 特定サービス産業動態統計_パチンコホール of game machines, Net sales of pachinko halls (YoY Number 売上高・設置台数(前年同月比、%) statistical survey of selected service industries) Change: Dynamic [Reference] Pachinko business scale Dynamic statistical survey of selected service industries - pachinko hall Net sales of pachinko halls (YoY Change: Dynamic 特定サービス産業動態統計_パチンコホール_売上高(前年比) statistical survey of selected service industries) Our net sales of Information System Segment (YoY Change) 弊社_情報システム事業_売上高(前年比) Business strategy Information System Segment Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 30 Generic strategy Information System Segment Conduct in earnest investment for the development of next-generation product lines Continue to provide value-added services by striving to strengthen our relationship with MIRAIGATE users Create products that are competitive in the market and launch the new products in the market in a timely manner Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 31 Business strategy Control System Segment Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 32 Generic strategy 制御システム事業 Operational contribution to pachinko halls Start making game machines with an eye to the market environment three years ahead Sales of multiple models of pachislot game machines Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 33 Towards the full-scale expansion of pachislot business Increase sales volume with multiple models, aiming for operational contribution to halls FY2014 Results * "Gross profit of cumulative total machines" indicates: The total of "machine gross profit" during the period from its launch to the point where it falls below the DK-SIS average operation About the performance contribution of Prism Nana Sales volume : about 4,000 ( Source of data )”DK-SIS white Paper” Daikoku Denki Pachislot model contribution ranking: 19th/74 models (ART type released in 2013) Operational contribution: 10 weeks achieved Gross profit of cumulative total machines: ¥547,000 (gross profit contribution achieved) FY2015 We plan to sell plurality of model in pachislot models Sales volume FY2014 FY2015 Results Forecast Developed with a focus on "Moe Slots", which has been attracting the attention of the "anime generation" 1 2 3,949 12,000 Create high-operation pachislot products that are sought by "fans" and "halls" and become a company that is counted on by anime fans Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 34 Mid-term business plan Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 35 Generic strategy Realization of growth based on evaluation and trust Information System Segment Positioning the next three years as an important period to lead into the following years when next-generation systems will be completed, the Company will further enhance our brand evaluation through the proposal of new services and products, while laying the foundation for our services as a pachinko hall management company. Control System Segment (1) In order to efficiently develop models that win support from many pachinko fans, the Company will strengthen our relationships of trust with game machine manufacturers. (2) Improvement of earnings by turning the pachislot business into the black Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 36 Generic strategy Realization of growth based on evaluation and trust Net Sales 210 Segment income 11 220 5 61 360 330 2014年3月期 FY2013 2015年3月期 FY2014 43 2016年3月期 FY2015 2017年3月期 FY2016 2014年3月期 FY2013 2015年3月期 FY2014 2016年3月期 FY2015 2017年3月期 FY2016 <Information System Segment> Positioning the next three years as an important period to lead into the following years when nextgeneration systems will be completed, the Company will strengthen our ties with pachinko hall management companies (i.e. increase profitability) through the reinforcement of MG services, and will increase sales through the timely proposal of new products. <Control System Segment> Development of game machines that can contribute to operations and improvement of earnings by turning the pachislot business into the black. Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 37 Dividends Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 38 Dividends <Policy> The Company implements "special dividends" according to the revenue based on "consecutive dividends" Net sales (Millions ¥) Net income Operation income FY2011 Results 34,483 226 △342 -% FY2012 Results 47,096 3,525 1,663 35.6% FY2013 Results 58,861 7,023 4,161 32.0% FY2014 Results 56,954 5,338 3,278 36.1% FY2015 Forecasts 55,000 3,000 2,000 29.5% (¥ per year) 100 90 80 The Company pays "special dividends" according to performance. (Indicated in orange in the graph) 80 60 40 Shareholders' equity ratio 40 40 40 Consecutive dividends 20 (Interim dividend of ¥10 and year-end dividend of ¥30) 0 2011/3期 FY2011 2012/3期 FY2012 特別配当金(期末) Consecutive dividends Special dividends 2013/3期 FY2013 期末配当金 2014/3期(予) FY2014 特別配当金(中間) Interim dividend Interim dividend 2015/3期(計画) FY2015 (Forecast) 中間配当金 Year-end dividend Year-end dividend Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 39 Disclaimer The contents in this material and comments made during the questions and answers etc. of this briefing session are the judgment and forecasts of the Company’s management based on the currently available information. These contents involve risk and uncertainty, and the actual results may differ materially from these contents/comments. ■Contact details for inquiries Daikoku Denki Co., Ltd. Inquiries: Investor Relations E-MAIL [email protected] Copyright ©DAIKOKU DENKI Co., Ltd. All rights reserved. 40

© Copyright 2026